The Pets Care Blog

Exploring the World of Repossessed Storage Buildings

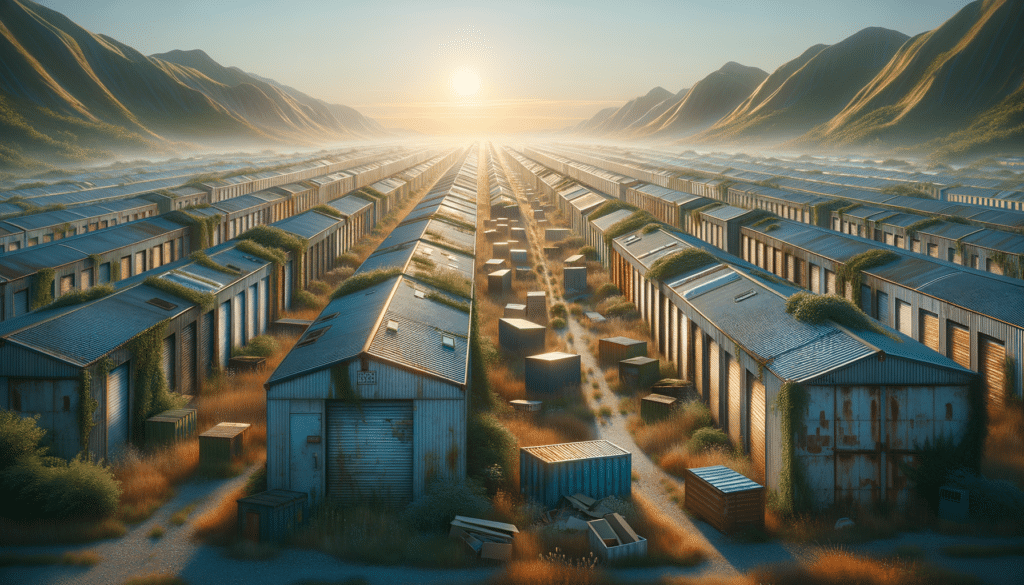

Introduction to Repossessed Storage Buildings

Repossessed storage buildings present a unique opportunity for individuals and businesses seeking cost-effective solutions for their space needs. These buildings, often available at a fraction of the cost of new constructions, can serve various purposes, from personal storage to business operations. Understanding the dynamics of repossessed storage buildings can help potential buyers make informed decisions.

The appeal of repossessed storage buildings lies in their affordability and versatility. As these buildings are typically sold by financial institutions or auction houses eager to recoup losses, buyers can often secure them at significantly reduced prices. This makes them an attractive option for budget-conscious consumers and businesses looking to expand without incurring excessive costs.

Benefits of Choosing Repossessed Storage Buildings

One of the primary benefits of opting for repossessed storage buildings is the cost savings. These buildings are usually sold at lower prices compared to new structures, providing a financially viable option for many. Additionally, the quick availability of these buildings can be advantageous for those who need immediate solutions.

Another advantage is the variety of options available. Repossessed storage buildings come in different sizes and designs, catering to diverse needs. Whether you require a small shed for personal use or a larger structure for business operations, there is likely a repossessed building that fits your requirements.

Moreover, purchasing these buildings can be an environmentally friendly choice. By reusing a repossessed building, you contribute to reducing the demand for new materials and the environmental impact associated with new construction.

Considerations When Purchasing Repossessed Storage Buildings

While repossessed storage buildings offer numerous benefits, there are several factors to consider before making a purchase. Firstly, it’s essential to assess the condition of the building. Since these structures are sold “as-is,” potential buyers should thoroughly inspect them for any damages or required repairs.

Additionally, understanding the legal aspects is crucial. Ensure that all necessary paperwork is in order and that there are no outstanding liens or legal issues associated with the building. Consulting with a legal expert or real estate professional can be beneficial in navigating these complexities.

Lastly, consider the location and transportation costs. The building’s location can significantly impact its utility and accessibility, while transportation costs can add to the overall expense. Evaluating these factors will help ensure that the purchase aligns with your logistical and financial capabilities.

Financing Options for Repossessed Storage Buildings

Financing a repossessed storage building can be different from traditional property purchases. Buyers may find that some financial institutions offer specialized loans for such purchases, though terms can vary widely. It’s advisable to shop around and compare different financing options to secure the best deal.

Some buyers might consider personal loans or lines of credit as an alternative to traditional financing. These options can offer flexibility but may come with higher interest rates. It’s important to weigh the pros and cons of each financing method to determine the most suitable option for your financial situation.

Additionally, some auction houses or sellers might provide in-house financing options. While convenient, it’s crucial to scrutinize the terms and conditions to avoid unfavorable agreements.

Conclusion: Making the Most of Repossessed Storage Buildings

Repossessed storage buildings offer a practical and cost-effective solution for those in need of additional space. By understanding the benefits and considerations associated with these buildings, buyers can make informed decisions that align with their needs and budget.

Whether for personal use or business expansion, repossessed storage buildings can provide the space and functionality required without the high costs associated with new constructions. As with any investment, thorough research and careful planning are key to maximizing the benefits of purchasing a repossessed storage building.